Top Features to Look for in Saas ATM Management Software

Efficient and cost-effective ATM operations are critical for banks and financial institutions to succeed. Software-as-a-Service (SaaS) ATM management software offers a cloud-based solution that significantly boosts ATM performance and reduces operating overheads.

When evaluating ATM management software solutions, understanding its capabilities is crucial to maximizing your investment.

Key SaaS capabilities for modern ATM management

A robust SaaS ATM management platform is essential for comprehensive ATM transaction management. Beyond mere transaction processing, it should include advanced, real-time data analytics and reporting, crucial for optimizing decision-making.

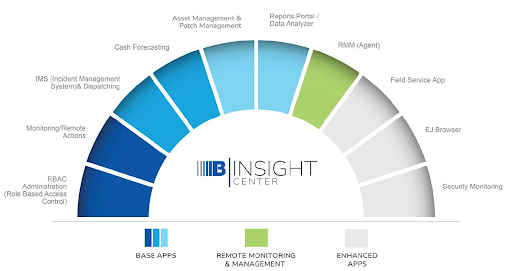

A key differentiator is Brink’s Insight Center’s (BIC) agnostic capability: it can monitor and support any bank’s diverse ATM fleet, regardless of manufacturer. It supports all major OEM hardware (including NCR, Diebold, Hyosung) running on Windows and adhering to the latest XFS standards.

Unlike other ATM managed services providers, Brink’s doesn’t manufacture hardware, guaranteeing unbiased solutions focused solely on optimizing your ATM performance and costs. Brink’s ability to customize software to each client’s unique configuration ensures perfect alignment with their operational needs, delivering optimal performance and user experience.

Real-time ATM monitoring and alerts

Brink’s Insight Center (BIC) is built on industry-proven technology already deployed across hundreds of thousands of ATMs worldwide. It features an embedded software agent that captures accurate information, enabling proactive incident response and live status tracking to swiftly address and resolve faults.

ATM monitoring software must offer real-time visibility into your entire ATM network’s health by continuously monitoring both the ATM’s physical components (such as card readers, dispensers and printers) and its cash components (such as precise cash levels in each cassette, dispense errors and cash-out predictions).

When an issue is detected, automated fault ticketing via our in-house monitoring software ensures that incidents are logged and routed efficiently. This proactive approach ensures issues are addressed swiftly and consistently, significantly reducing the time an ATM is out of service, directly translating to improved uptime. This seamless process is actively supported by Brink’s local country teams, who manage customer engagement, coordinate BIC onboarding, collect and manage estate details, and handle BIC requests and issues.

Remote incident management and helpdesk

Effective ATM monitoring systems are only as powerful as the operational centers backing them. Brink’s supports its global ATM managed services business with two primary Regional Operations Centers (ROCs).

These centers, strategically located in Billings, USA (with support from Bogota, Colombia, monitoring over 10,000 ATMs), and Manila, Philippines (serving customers across Indonesia, the Baltics, UAE and the Philippines), are staffed by expert technicians providing 24/7 local coverage with global backup capabilities.

Their responsibilities span platform development and maintenance, deep understanding of vendor product lines and seamless local country account management support. Furthermore, each Brink’s ROC maintains a dedicated local account operations team to manage the customer experience and effectively escalate the dispatch of third parties when necessary.

Proactive monitoring and real-time alerts identify issues as they occur, often using remote diagnostics to troubleshoot software faults and reduce costly on-site engineer visits.

This results in streamlined remote incident management, where automated fault ticketing, intelligent detection and root cause analysis ensure swift, consistent issue resolution.

With Brink’s Insight Center, banks and financial institutions benefit from the convenience of a single provider managing their entire ATM estate. Brink’s handles all aspects of identification, troubleshooting, dispatching and reporting. A dedicated customer availability dashboard also provides comprehensive, real-time visibility of your ATM estate at all times.

The extensive capabilities of Brink’s platform and staff experience is a key differentiator. Helpdesk agents support all major ATM manufacturers and resolve issues ranging from the most basic to highly technical scenarios. You also gain access to key performance indicators (KPIs) managed directly within BIC, ensuring transparency and accountability for your ATM estate’s performance.

Brink’s helpdesk staff enhance this support, offering a personalized 24/7 phone support service. The helpdesk achieves impressive response times, with over 95% of calls answered, on average, in under 16 seconds.

This rapid response, combined with the expertise of helpdesk staff and Brink’s field engineers, is vital for mitigating downtime and ensuring maximum availability and efficiency. Our commitment to industry-leading SLAs directly translates to increased uptime, significantly enhancing customer experience.

Remote key loading

A top-tier SaaS solution enables remote key loading (RKL), a critical security feature that securely updates and distributes encryption keys (for example, Terminal Master Keys) to the ATM’s Encrypting PIN Pad (EPP) from a central point; this eliminates costly, time-consuming site visits by field engineers.

Comprehensive remote incident management also allows many issues to be diagnosed and resolved without dispatching a field technician. Remote command incident resolution, often through “straight-thru-dispatch” for common faults like bill jams, enables rapid fault resolution. This high remote fix capability significantly reduces ‘truck rolls’ to keep costs down and ensure ATMs run efficiently.

Fast implementation

A significant advantage of any cloud-based ATM software is its capacity for rapid implementation. By leveraging a SaaS model, banks avoid the complexities, significant capital expenditure and lengthy timelines typically associated with traditional on-premise ATM management software deployments.

This swift onboarding, facilitated by a proven process and meticulous coordination between global managed services teams and local client engagement, allows banks to quickly realize the benefits of centralized management and control over their ATM fleet.

The ATM monitoring software can integrate directly into the financial institution’s ATM software package for streamlined distribution, further simplifying deployment and reducing time-to-value.

This rapid setup provides faster access to crucial features like advanced reporting and analytics, automated cash forecasting and replenishment, and predictive maintenance. It also ensures seamless integration with payment systems, offering a scalable, flexible solution with customizable dashboards and user interfaces.

Improved uptime and operational efficiency

The ultimate goal of any ATM management software is to maximize ATM uptime. Brink’s Insight Center achieves this by consolidating and automating monitoring, incident management and dispatching, providing an availability guarantee that directly mitigates reputational risk for banks and financial institutions.

Partnering with a single, subscription-based supplier like Brink’s shifts the complexities and variable costs of licensing, staffing and software maintenance to the managed service provider, offering a single point of accountability and a predictable OpEx model.

Financial institutions gain immediate, transparent access to critical information through a secure, desktop and mobile-friendly Customer Web Portal. This intuitive portal provides real-time ATM status and incident updates via an interactive map and incident grid. Customers can also review Electronic Journal (EJ) Viewer data for dispute resolution or transaction research, and access comprehensive SLA reporting, including on-demand ad-hoc reports and detailed uptime and availability metrics.

Data-driven insights empower banks to optimize cash management through precise cash forecasting, which predicts future demand and minimizes idle cash. The combination of proactive problem detection, swift resolution and enhanced security features – all compliant with regulatory guidelines like PCI-DSS – ensures your ATM network remains secure, compliant and available.

Finding the right SaaS ATM management software

Investing in a SaaS ATM management software solution that offers agnostic support, advanced analytics, automated processes and expert services, is key to helping you transform your ATM networks.

The right SaaS ATM management software isn’t just an expense; it’s an investment in your bank’s future efficiency and customer satisfaction.

To learn more out Brink’s Insight Center, please get in touch.